// ja nevim, jestli je to paranoiou, ale prijde mi komicke verit, ze na planete Zemi, ktera co si budeme povidat, ma hodne problemu , zlocinosti a korupce a historii genocid, budou ti nejvetsi hraci nejaci supergood guys, altruisti , co jen chteji poskytovat investicni vyhody pomoci jejich fondu, ale klient je jejich pan. Ze on je ten , kdo vlastni ty penize, on, kdo rozhoduje.

Tak jednak ono to budou z velke casti podobny smejdi jako ten Fink a BlackRock imho :-)

Druhak nejenze se mi jevi ta role minoritnich aktionaru ve fondech BlackRocku a Vanguardu (Vanguard vlastni velkou cast samotnyho BlackRocku, takze to je taky zajimavy ;-) ).. jako pohadka, ktery se da snad leda verit, protoze tahle role pusobi dost shady... ci jako blackbox

Viz nize.... samotni celni lidi BlackRocku jsou velmi provazani s politikou a je tam rada lidi z FEDu, SEC, Bidenovi administrativy.. proste klasicke ano jelita

A pak pri financni krizi 2008 je BlackRock statem USA poveren, aby resil financni krizi, prestoze samotny BlackRock je ve stretu zajmu?Tohle nebudou nejaci altruisti, co jako "chudaci" kupuji akcie GameStopu, protoze si nejaky reddit forum hraje vlastni financni machinace. :)

Ze jsou peceni vareni na Bilderbergu me ani neprekvapuje.

--

Jinak osobne si nemyslim, ze nejaky Vanguard/BlackRock ridi svet. To jsou predstvy, ktere jsou casto podsouvany.. ve filmech a jinem narativu. Ten Fink, CEO ci co BlackRocku, to nebude imho zadny Dr. Evil.

Ani Schwab, Bill Gates,

Vsechny ale struktury a site formalnich i neformalnich kontaktu mohou umoznovat fungovat jakesi stinove vlade.

A protoze lidi maji tendenci si ta zlocinna spiknuti simplifikovat, maji dojem, ze by se muselo provalit.

Jak rekl Bill Gates : "Proc bych mel sledovat lidi, co meli COVID vakcinu? Co bych tim ziskal?". Prestoze na jinem speechy jasne se primlouva pro globalni program ID2020 (?) .

On to otocil ve strawmana... co on by z toho mel, ze muze sledovat Frantu Novaka? On nic. Protoze o nej tu nejde.

Idea je, ze on dela svou roli.

Jestli je nejakej jeden nebo nejakej velkej overlord, tohle budou spis pesaci, co jsou radi, kdyz je nepredhodi reptilianum k obedu, kdyz to prezenu :-))

Ale protoze Bill Gates je aristokrat, urozene krve, zrejme se citi vic v bezpeci nez jini.

Tyhle lidi imho nepotrebujou skutecne vedet o pohybu kazdeho cloveka a jeho vakcinacnim statusu....

spis si zit klidnej zivot nekde na jachte..

Zrovna Bill Gates se spinuje do narativu, jak chce ridit nebo ridi svet.. aby to bylo i absurdni.

OBsas si nekoho pozvou do Bilderbergu na pokec... a u sklenice draheho vina spolu kazdy rok diskutuji o smerovani sveta. Samozrejme ze neformalne... zadna formalni rozhodnuti tam nepadaji, proto to neni konspirace :)

Ale obcas se nekdo prokecne.. jako Zbigniew Brzezinsky, kdyz rekl v TV interview, ze ad Bilderberg a dominujici sily jsou samozrejme jsou i dealy, ktere jsou "pod stolem"

Nebo kdyz novinarum nejaky bilderbergovec, politik rekl "EURO jsme vymysleli na Bilderbergu! Fajn parta"

Nemaj zadny vliv. Jenom si povidaji. :)

A BlackRock/Vanguard nam jen starostlive spravuji penize

Dovolim si tehle teorii neverit :-)

V mnohach statech sveta je dominantni korupce... politici opakovane slibuji snizeni, boj s korupci.. to same EU. Ale tihle nejmocnejsi, nejbohatsi, nejvlivnejsi lidi jsou shodou okolnosti altruisti, kterym jde o moje blaho? Ti do te korupce shodou okolnosti nepratri? ,) Malo pravdepodobne.

---

.... sic ne nemozne.. . ale ony i ty bailouty v 2008, kterymi byl BlackRock poveren, jsou neco dodnes hodne divneho. Rozdalo se 2,3 bilionu USD protekcionisticky bankam a korporacim.

... to komu se rozdelily ty prachy... a ze tohle samozrejme ustilo k jeste vetsi inflaci.. to se jakoby moc neresi.

A kdo u toho stal ? BlackRock :-)

Ale to je samozrejme jen nehoda.. oni jsou precejen v tehle veci nejvetsi experti, tak koho jineho by mely USA pozadat o pomoc s resenim krize jineho nez nejbohatsi investicni fond na svete?

Proto i ex-reditele farmaceutickych firem jsou v politice a naopak... lide z Goldman Sachs jdou sefovat do FEDu a zpet atd. proste jsou to nejvetsi experti. Tak je logicke, ze je osud dovanul do vysokych pozic ve vlade i byznysu.

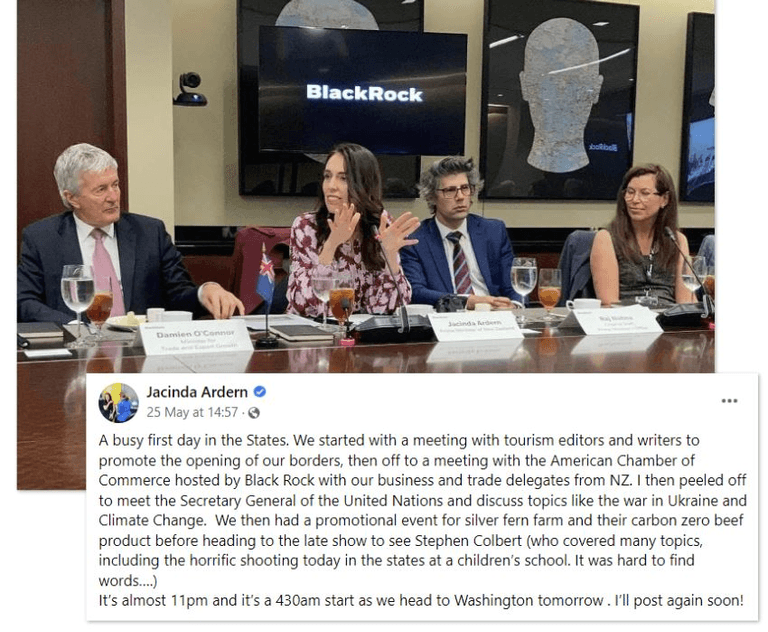

Conspiracy theorists are losing their shit over a clip of Jacinda Ardern in New York | The Spinoffhttps://thespinoff.co.nz/politics/08-06-2022/conspiracy-theorists-are-losing-their-shit-over-a-clip-of-jacinda-ardern-in-new-yorkThe nakedly QAnon conspiracy theorists got in on the act, too. “New Zealand’s pro-tyranny PM Jacinda Ardern is filmed coming out of the globalist Death Star financial headquarters at BlackRock,” gurgled one prominent QAnon account on Gab, the social network beloved by the far-right. Endless comment threads filled with the usual screeds of invective, dystopian fantasy, casual comparisons to Nazism and a big serving of misogyny. Naturally, New Zealand’s own disinformation groups eagerly shared it.

But just how insidious and secretive was Ardern’s BlackRock visit? So insidious and secretive that you can find evidence of it on, well, her own Facebook page on the day it happened.