E2E4: "Ergo, Peak Oil jsou spekulace o téměř nulové hodnotě." Nepřekrucuj. To za prvé. Za druhé jsem se vyjádřil ne úplně přesně, nemá smysl špekulovat o tom, kdy přesně byl peak oil či kdy přesně bude, má však smysl celé toto uvažovat v širokých souvislostech, jaké to bude/mělo dopady na cenu ropy, na průběh těžby v jednotlivých ložiscích, jak se takové dosažení vrcholu těžby mohlo/nemohl podepsat, podepsalo/nepodepsalo na ekonomice atp.

"žádná peak oil předpověď (z těch co jsem psal níže) nevyšla" - no, ale ono v závroce obsažené je vcelku pozoruhodné upřesnění, protože jinak ses tu opíral o všechny předpovědi peak oilu a že žádné zatím nevyšly! Takže si prosím tebe nejdříve ujasni, o čem nám tu chceš psát, a pak něco sepisuj, protože jinak plýtváš časem a trpělivostí druhých.

Ad Tainter. - Usuzuješ tak jenom proto, že narozdíl od Diamonda neklade takový důraz na environmentální katastrofy a na limity prostředí? - Musím tě zklamat. M. Kašík na jednom fóru píše: "V rijnu lonskeho roku se v Syracuse konala Druha konference o biofyzikalni ekonomii poradana Charlesem Hallem. Nektere presentacce vcetne hodinove zvane prednasky Taintera jsou k nalezeni zde

http://web.mac.com/biophysicalecon/iWeb/Site/BPE%20Conference.html .

Neni prekvapive, ze Tainter prece jen posunul vyznam energie a (ne)dostupnosti energertickych zdroju na jeden z hlavnich a nejdulezitejsich pricin civilizacnich kolapsu. EROEI je dulezitym tematem jeho prednasky.

Na konfereci byla spousta dalsich zajimavych prispevku z ruznych pohledu a oboru. Za pozornost take stoji Jack Alpert (viz jeho prispevek na konferenci a jeho stranky

http://www.skil.org/) . Jack Alpert na svych strankach pomerne presvedcive ukazuje, ze pocet populace se ustali (pokud vubec) nekde na 50 milionech. Sam jsem si delal modelovani dynamickeho vyvoje populace a zavery nejsou hezke."

ITCHY: "tak jinak JAK EROI menší jak 1 a je jedno jestli to bude 1,3 nebo 5 OVLINÍ to zda jsme či nejsme schopni fyzicky=technologicky=dostupnými prostředky zvýšit PŘÍPADNOU sestupnou tendenci TEORETICKY maximální možné těžby=klesající objem JAKKOLIV (nerovná se snadno dostupných) zásob" - Nebudu ti odpovídat na otázky, na které si snadno můžeš odpovědět sám, když si nastuduješ základní literaturu, jelikož jsi tak zatím neučinil, tak kladeš slušně řečeno neobeznámené dotazy.

- Eroei ropných písků není možné jako i jiné eroie dost dobře počítat.

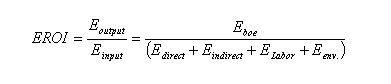

The issue of EROI is different from most other fuels because the energy source for the process is from the resource itself and it has no other alternative economic uses. This is different from “diverting” energy either from society (e.g. to mine coal or grow a biomass fuel) or from a situation where the energy could be immediately used by society (natural gas used at a petroleum well to run a pump vs being piped to society). The oil sand EROI is calculated by the following formula, although only direct and indirect input energies tend to be used by most analysts:

Where: Eoutput = Eboe = Energy content of one barrel of oil equivalent (6164 MJ)

Einput = Total energy input (MJ/boe)

Edirect = Direct energy demand (only the energy flows) (MJ/boe)

Eindirect = Indirect energy demand (e.g. energy to make capital equipment) (MJ/boe)

ELabor = Labor energy demand (Includes labor and maintenance) (MJ/boe)

Eenv. = Environmental energy demand (Kyoto protocol, others) (MJ/boe)

In this case the energy output is relatively simple to calculate as it is equivalent to the energy content of one barrel of crude oil. The energy input, however, is more complicated. We determined the energy content of the different processes involved within the research boundary (extraction, separation and upgrading) separately by a “bottom-up” accounting framework approach. The direct energy is efficiency corrected (i.e. primary electricity is multiplied by three) and calculated in MJ. It is not calculated back to all primary energy used e.g. if diesel was used in the process, the energetic extraction, refinery, and transportation cost of that fuel is not calculated. Rather only the energy content of diesel is used as a parameter. Thus the EROI numbers we generate are conservative (i.e. higher than if more comprehensive boundaries are used).

We determined the indirect, labor, and environmental components of the EROI, used in sensitivity analysis, by calculating the total dollar costs per barrel for each of these sectors (see Figure 2) per boe and then multiplied by the energy value per USD2006. Indirect energy includes capital costs per boe (corrected for the capital recovery factor). Labor includes only the direct labor and maintenance per boe. Environment costs include the CO2 emission trading cost per boe (from the Kyoto protocol) as an indicator for the GHG emission costs, and anassumed socio-environmental costs for the impacts to the direct surroundings.

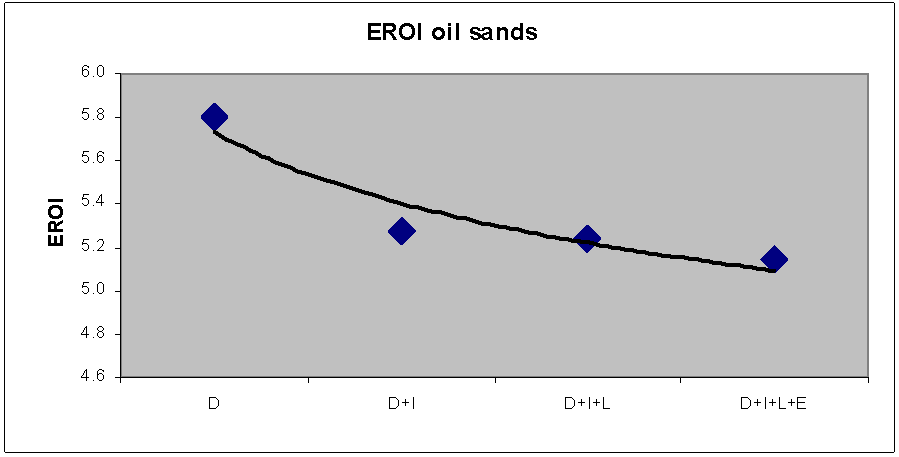

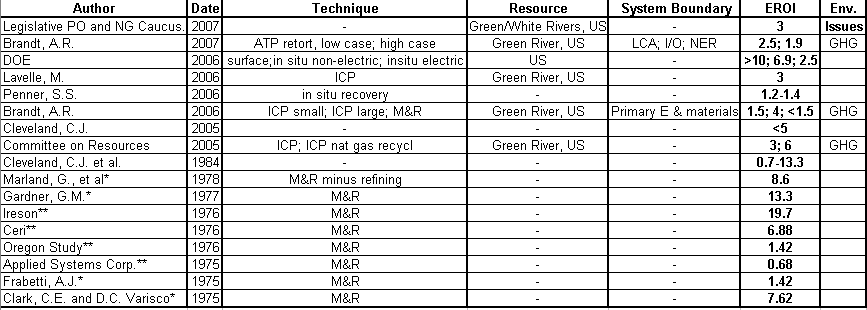

By our admittedly incomplete calculations the EROI depends mostly upon the direct energy used and which alone suggests an EROI of about 5.8:1(Figure 1). Including indirect energy decreases the EROI to about 5.2:1, and adding in labor and environmental costs have little effect. A comparison with the limited other data out there indicates that our analysis generates a somewhat higher EROI than others (Table 1). Nevertheless it appears that tar sands mining yields a significantly positive EROI.

"EROI

Reported EROIs (energy return on investments) are generally in the range of 1.5:1 to 4:1, with a few extreme values between 7:1 and 13:1. The main difference between oil sands and oil shale is that the oil sands are particles of sand, surrounded by a microscopic layer of water that is itself surrounded by heavy bitumen (thick oil). Separating the oil from the oil sands is much easier because of this water layer, since the oil is ‘‘suspended’’ in the water/sand layer and not directly stuck on or in the sand as is the case for oil shale. This makes oil shale much more energy intensive to separate (Ibid). As such, shale oil production - whether through surface retorting or ICP - is more energy-intensive than conventional oil production or from tar sands, and even enhanced recovery from oil fields. In fact, upstream energy consumption per unit of final fuel delivered is roughly 1.75-2.75 times that of conventional petroleum production (Brandt 2007). Tar sands and oil shales seem to be in the same “EROI ballpark”.

Shell reports that in their ICP in situ process they consume 1 Btu for every 3 Btu’s of energy produced, corresponding to an EROI of 3:1 (Ibid). However, if the energy input is electricity and the output oil this would imply a quality-corrected EROI of close to unity. On the other hand the utilization of natural gas produced during the ICP in-situ process doubles the energy efficiency to 6 Btu of energy produced for each Btu consumed corresponding to an EROI of 6:1. In addition shale oils are a special case, like tar sands, where a large proportion of the energy can be generated from the resource itself (Ibid).

For the mining and retort process, the net energy return (NER) is very low if total energy inputs are counted (NER lower than 1.5) (Brandt 2006, 2007). In a more recent study, Brandt concludes that the EROI for shale oil production using an ATP retort (a method reported to have the highest conversion efficiency – 88%) is somewhere between 1.9 and 2.5 (2007). However, based on a study in Kentucky USA, if some of the measurable environmental costs associated with shale oil production are included, the EROI drops another 3-9% (Lind and Mitsch 1981). Furthermore, Cleveland concludes that the EROI for shale oil ranges above and below the break even point, depending on assumptions regarding location, resource quality, and technology characterization (2005). The use of microwaves, an old technology with new enthusiasts behind it, supposedly would generate higher EROIs but there have been studies of this yet in actually field conditions. "

...

CONCLUSION

In conclusion, tar sands are an economically and energetically viable, although hardly ideal, approach to maintaining liquid fuel supplies. The most severe problem is probably their local and global environmental impact, and they are already impacting Canadian CO2 releases significantly. But the tar sands are unlikely to make a large impact on overall supply of liquid fuels because their supply is likely to be rate, rather than total resource limited. If the maximum rate were to grow to about 2 billion barrels a year this would approximately meet Canada’s demand and could leave relatively little for export if Canada’s production of conventional oil continues to decline. Achieving even this rate of production from tar sands is uncertain because of growing concerns about environmental impacts downstream and insufficient hydrogen and water.

...

In conclusion, although shale oils represent a huge potential resource they have a history of “always a bridesmaid and never a bride” because as prices for oil increase the prices for extracting shale oil have increased as well. This history represents the very real problems of generating a useful product from the resource. The main problems include the distance of the shale from both the water and labor needed to extract it, the large environmental impact compared to conventional oil and the relatively low EROI . In addition, with both shale and tar sands there is some disagreement whether the in situ should be charged as an energy opportunity cost, (in the same sense that bagasse could be in sugar cane ethanol). Ultimately, the question is, if conventional oil becomes very scarce whether a resource such as shale oil will be developed regardless of cost.